Komainu

Connect

Make Your Assets Work Harder

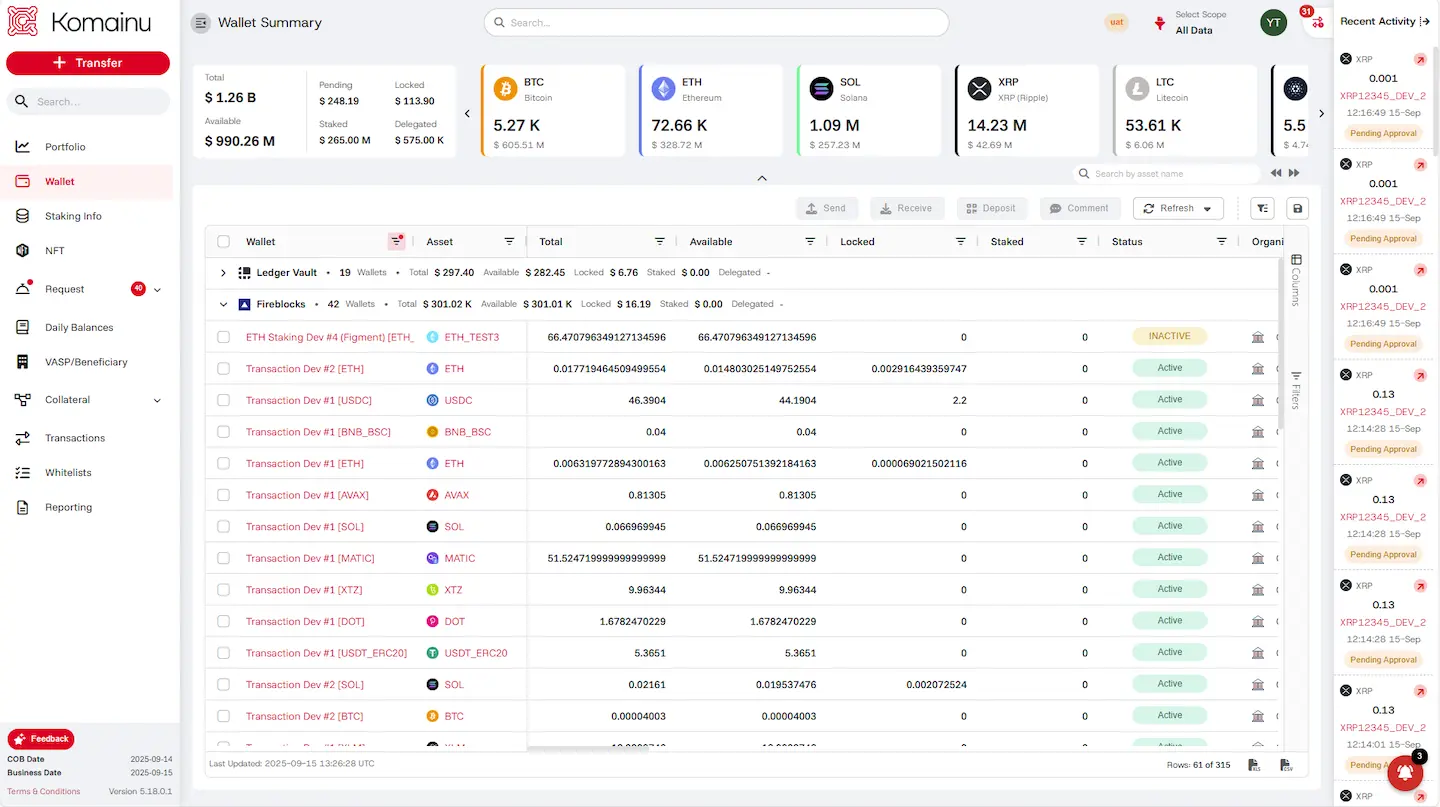

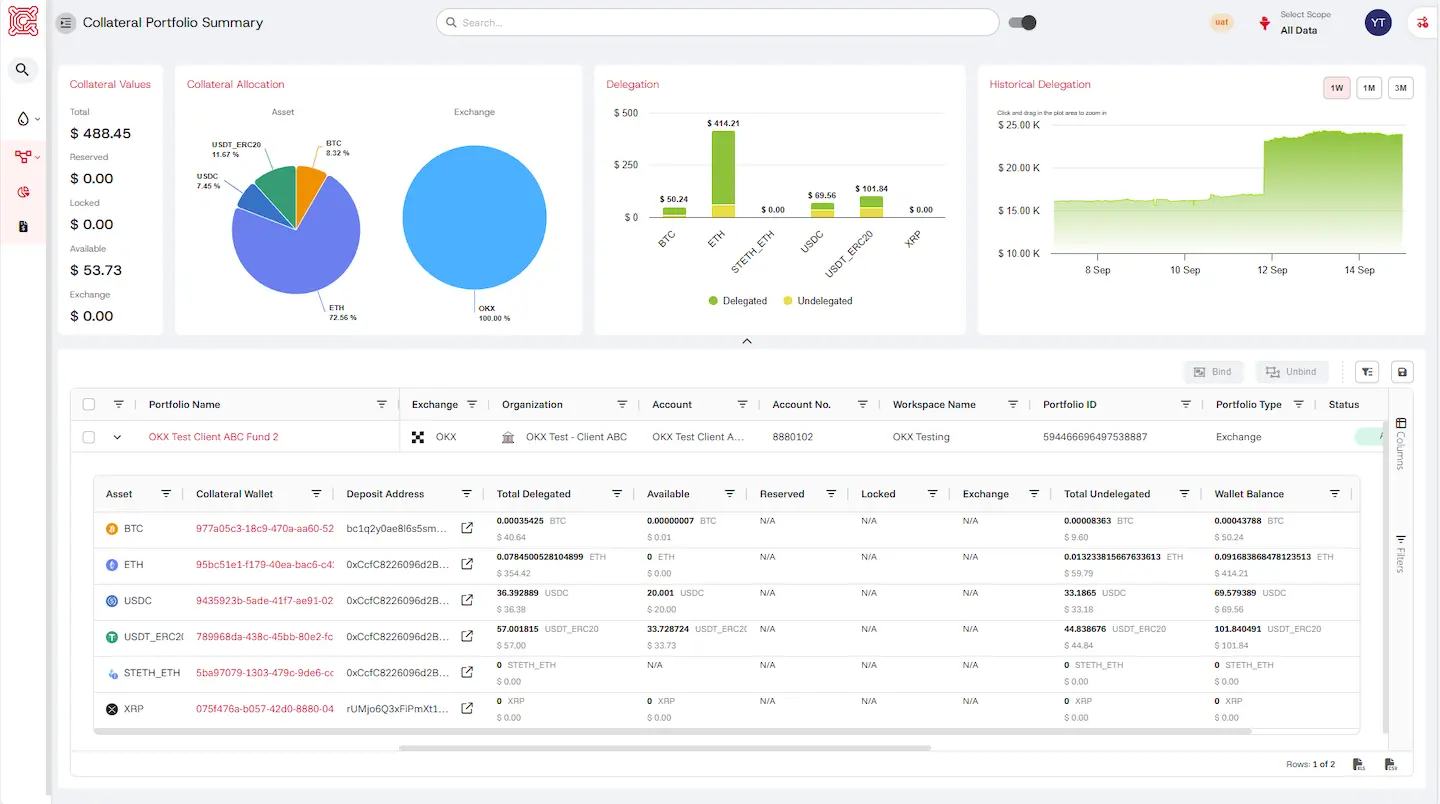

Komainu Connect offers bank-grade collateral management, enabling you to trade, borrow, and lend while keeping your assets held in secure custody.

Our purpose-built service entirely removes the need for pre-funding of third-party venues, as assets remain in segregated wallets with full on-chain transparency.

Robust legal frameworks and Account Control Agreements ensure security, segregation and accountability, giving our clients the ability to mitigate counterparty risk and confidently unlock liquidity opportunities.

Improve capital efficiency without compromising security or compliance.

Mitigate Counterparty Risk

Access Institutional Liquidity

Increase Asset Utility

Key Features

Komainu Connect offers the transparency, protection, and support institutional investors

need to manage trading, borrowing and lending with confidence.

Ecosystem Access

Komainu provides independent custody with seamless integration to a growing list of exchanges, prime brokers, and lending platforms.

Connecting you to liquidity venues and active market participation across the global digital asset ecosystem.

Increase Capital Efficiency

Make your assets work harder with Komainu Connect.

Built to enhance capital efficiency and mitigate counterparty risk, while maintaining full control through secure, segregated, on-chain custody.

Tokenised Asset Support

Komainu Connect supports a range of tokenised assets, enabling you to use them as collateral to unlock liquidity.

Enabling the use of yield-bearing tokens across our partner network, while your assets remain in secure custody.

Robust Legal Framework

Our Account Control Agreement integrates legal precision with operational clarity, ensuring secure alignment between Komainu, the client, and our partner venues.

The framework is backed by a robust legal framework to protect your interests.

Insolvency Protection

Client assets are held off balance sheet, in bankruptcy-remote segregated on-chain wallets.

This adds a critical layer of protection, prohibiting any co-mingling of assets, meeting institutional risk management standards and mitigating counterparty risk.

24/7 Access

Trade, borrow, or lend anytime through our integrated network of partner venues.

Your assets remain securely held in custody, enabling capital efficiency without compromising on safety or compliance, with real-time collateral mirroring and intra-day settlement intervals.

Komainu Connect Partners

Coin Coverage

We have a growing list of assets supported for collateral on Komainu Connect, including:

BTC

ETH

USDC

USDe

BUIDL

BNB

PAXG

SOL

stETH

USYC

XRP

USDT

MATIC

Related Services

Explore more of Komainu’s digital asset services.

Custody

Bank-grade custodial protection.

Safeguard digital assets with best-in-class security and governance. Our custody solutions are purpose-built for institutional investors, offering robust controls, operational integration, and complete transparency.

Key benefits

- Independently verifiable, on-chain, segregated custody

- Choice of secure wallet technology, with built in redundancy

- Transaction approval automation and customisable risk profile

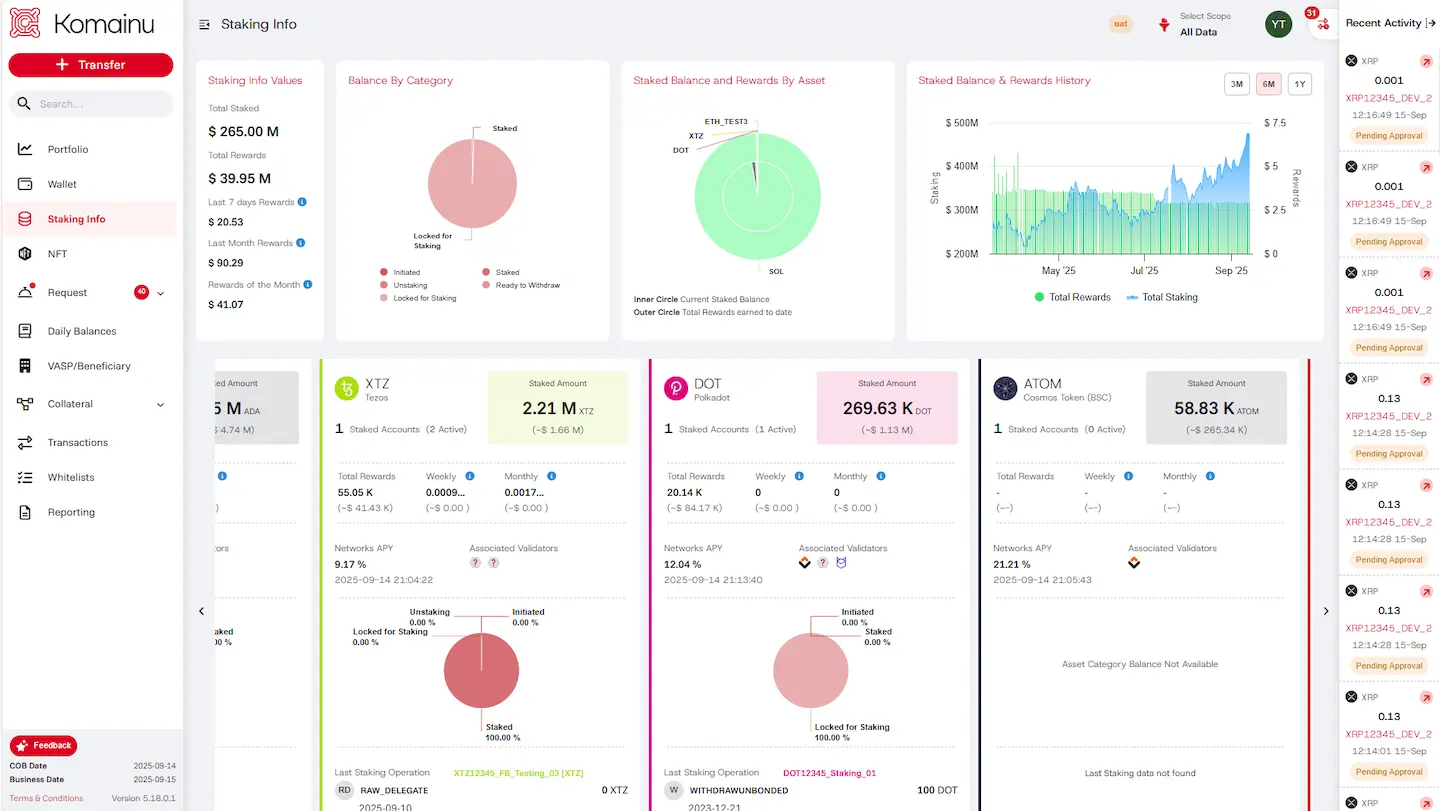

Staking

Increase asset utility by generating yield.

Through our bespoke staking solution, clients can earn blockchain rewards while assets remain in regulated, segregated custody.

Key benefits

- Access on-chain rewards through secure and regulated custody

- Detailed reward tracking and reporting

- Automated rewards and operational efficiency

News &

Insights

Contact Us

Reach out to our team today and discover how Komainu can help your institution participate in the digital asset ecosystem with confidence.